Navigate quickly

Selling Franchises In A Booming Economy

By almost every single economic metric available, the U.S. Economy is in the midst of quite the amazing growth spurt. Since the Great Recession of 2008-2009, you’ve seen just about everything go right.

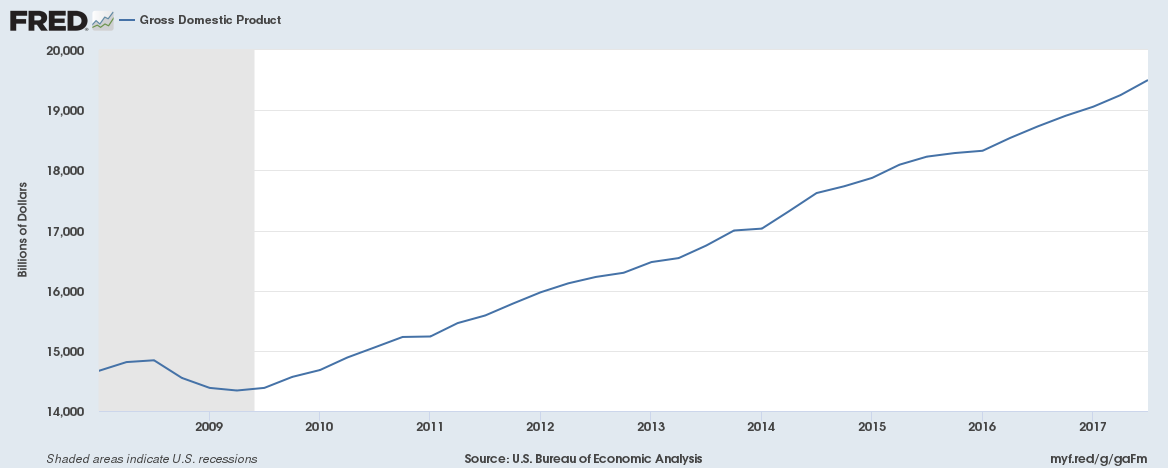

We’ve gotten to the point where the U.S. GDP is approaching the $20 Trillion level while being close to just $14 Trillion 9 years ago.

For the majority of us, this is an unequivocally fantastic thing. For those of us who were involved in the business world a decade ago, we’d rather not find ourselves in those times again. Obviously.

(Are franchises actually “recession-proof?” Take a look at my thoughts here.)

However, if you’re in the business of franchise sales, I would argue that it’s a far more complicated situation. As much as you think that now would be the best of times for franchise growth, I’m not sure that that unmitigated opinion is correct.

But first, let’s build the bull case for awarding franchises in a booming economy:

Potential Franchisees Have More Cash

Easily the most important factor in franchise sales is the ability of people to invest the necessary capital to get franchises started. Given that many franchises have net worth, investment, and liquid capital requirements, a booming economy means that more people meet those minimums. Especially for those who’ve been invested in the stock market (S&P 500 is up from $683 in March 2009 to $2,745 in January 2018), the bankrolls that are available to invest in new businesses has never been higher.

Your Unit-Level Economics Are Peak

Anyone who’s sold a franchise knows that the most important question to give a potential franchisee the answer to is “How much money can I make as an owner of one of your franchises?” The answer to that question can be make or break to receiving investment. And other than making sure that you’re following the rules when you answer, you have a keen interest in making those numbers as high as possible. When the economy is booming, it’s likely that your stores are doing well. When your stores are doing well, potential franchisees feel like they can make more as well.

Franchises Are More Likely To Invest In Development

A booming economy doesn’t only mean more money for potential franchisees, but it also means more cash in the pockets of franchisors! When your franchise’s bottom line has grown year-on-year for the last few years, it’s easier to raise development budgets. More budget means more leads. More leads means more sales.

These things are very, very important. And I’m sure your franchise development function feels the effects. But I will argue that there are a few additional features of growing your franchise in a more mature growth environment that may actually stand in the way of your franchise succeeding with growth.

It’s Hard to Beat Double-Digit Stock Market Returns

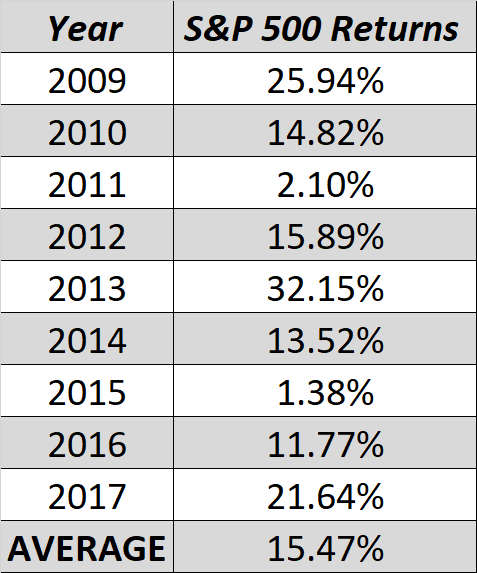

If you look at the S&P 500 returns from 2009 – 2017, you see this:

So using this super-naïve approach, someone with capital to invest may feel that they can get a 15% return on their money WHILE DOING NOTHING. (This just in, owning a business isn’t passive income.) When you’re trying to convince someone to open franchise locations, you know that the lead is certainly thinking about what else they could do with the money; opportunity cost if you would. In a world where the stock market is tanking, the investing in various alternative vehicles becomes much easier. When it’s booming, it’s much much harder.

Potential Franchisees Are Likely to Be Happier What They’re Doing Now

Opening a franchise goes hand in hand with the theme of change. The new franchisee is going to be making a big change in their lives and quite frequently that involves moving on from a job. If someone gets laid off, their pay is stalled, or their future prospects are bleak, then “change” can be easy. Our economy now sits at 4.1% unemployment and even wages have risen in the past couple years. Cushy jobs are the enemy of new franchises.

Competition Is Steeper, Much Steeper

Looking back at the three positive factors, you’ll notice that they don’t only apply to your franchise. It applies to all franchises. So any of the benefits from the economy provided could be completely cancelled out (if not rendered negative!) by the fact that your closest competitors were helped even more! A rising tide raises all ships, but a bigger ship could also ram the less fortunate ones.

Knowing where the economy is going to head is anyone’s guess. But at least as we sit here today, it’s green grass and high tides. It’s up to you to find a way to take advantage of the day.

Eli Robinson is the COO of Metric Collective, the parent company of FranchiseHelp. He also serves as the Chief Economist of the company.

Ultimate franchising guide

All you need to know as a first time franchisee: Step by step guidance from experienced franchise professionals.