Navigate quickly

Advanced Franchise Accounting Terminology

In our guide

to analyzing the profit potential of a franchise business, we provided basic

descriptions of several important accounting terms. Some people like to

really roll up their sleeves and get into the details, so for that audience

we've assembled the following guide to advanced franchise accounting concepts.

Fair warning: If learning about things like GAAP, revenue recognition policies, and the intricacies of cost vs. expenses makes your eyelids droop, feel free to skip over to the next article.

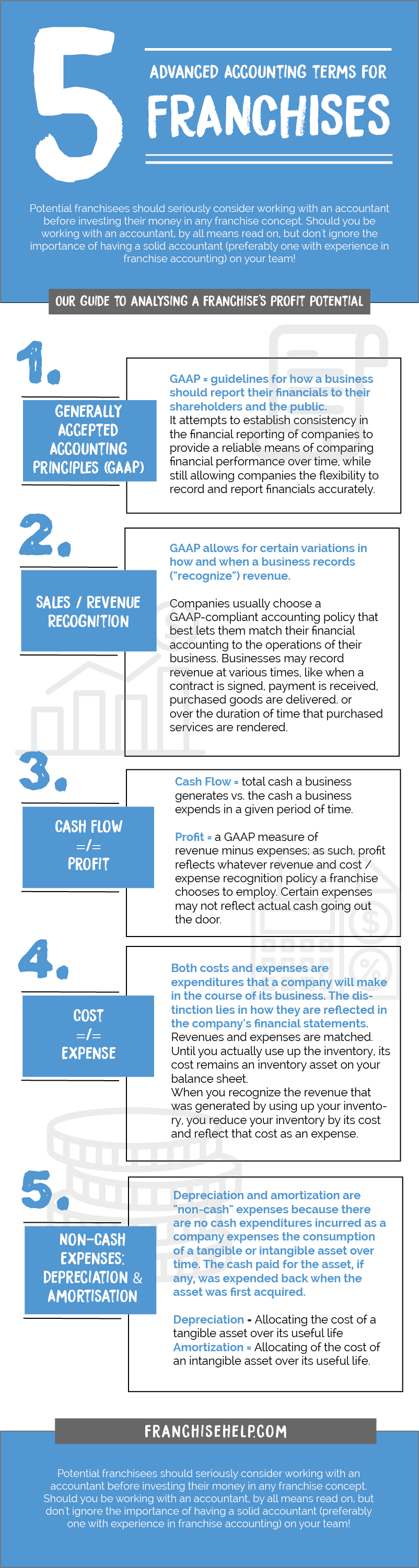

Important note: Potential franchisees should seriously consider working with an accountant before investing their money in any franchise concept. Given you should be working with an accountant, you don't really need to know the details we go into below. By all means, if you are interested in going deeper than the basics, read on, but don't ignore the importance of having a solid accountant (preferably one with experience in franchise accounting) on your team!

Here's an index to the topics that we cover below.

- Generally Accepted Accounting Principles (GAAP)

- Sales / Revenue Recognition

- Cash Flow is not the same thing as Profit

- Costs vs. Expenses

- Non-Cash Expenses

Generally Accepted Accounting Principles (GAAP)

Sales / Revenue, Costs / Expenses, and Cash Flow are accounting terms that are subject to a body of rules known as GAAP (Generally Accepted Accounting Principles), which lays out the guidelines for how a business should report their financials to their shareholders and the public.

GAAP guidelines attempt to establish consistency in the financial reporting of companies so that managers, investors, lenders, and analysts (as well as the SEC) have some reliable means of comparing financial performance over time (and across companies) while still allowing companies the flexibility to record and report financials in a way that most accurately reflects the operations of their business.

Sales / Revenue Recognition

In our guide to projecting franchise profitability, we defined sales (also called "revenue") as "the monies that a business receives in exchange for goods sold or services rendered over a given period of time." That's true, but that straightforward definition doesn't address the complexities of revenue recognition. GAAP (or International Accounting Standards for non-U.S. companies) allows for certain variations in how and when a business records ("recognize") revenue.

Why would there be variations in when revenue is recognized / recorded? Don't revenues get recorded as soon as a sale transaction is completed?

Well, that depends on what constitutes a completed transaction:

- Is a sale transaction considered complete when a a customer receives the purchased good or service?

- What if the customer doesn't pay for the good or service until 3 months later (ever see furniture store commercials that offer "no payments until next year")? Would it still be appropriate to record the full value of the "sale" on the day the furniture is delivered?

- Is the transaction considered complete when the customer pays? What if one company requires its customers to pay up-front for a year's subscription to their movie rental service while that company's competitor charges its customers the same total amount for a year's worth of service but spreads out the payments into monthly chunks? Would you say that the first company made the full year's sale at the beginning of the month while the second company made twelve separate sales spread over the year?

The answer is that companies usually choose a GAAP-compliant accounting policy that best lets them match their financial accounting to the operations of their business.

Some businesses, like your local auto dealer, may record revenue at the very moment a contract is signed (e.g., you purchase a new car and the dealership immediately records the full sale price on their books, even though you won't be receiving the car for two weeks and you won't be paying the full amount agreed until you take delivery of the vehicle).

Others businesses may recognize sales at the time their customer's payment is received (e.g., you purchase a bouquet of flowers online, paying with your credit card, so the business receives the funds immediately, and the florist site records a sale at that moment even though it will be another 2 days before the flowers are delivered).

Still other businesses may recognize revenue at the moment the purchased goods are delivered (e.g., you pay $30 to pre-order a new book from Amazon, but Amazon doesn't record the revenue until they send you the book two months later).

Finally, some businesses recognize revenue over the duration of time that purchased services are rendered (e.g., you pay $24.00 up front for a year-long subscription to your favorite monthly magazine, and the magazine publisher recognizes $2.00 of revenue per month on their books for each month of your subscription).

While not always the case, most companies in a given industry will tend to use similar revenue recognition practices, so you should be fairly confident comparing a franchise's sales figures against those of its competitors. Even in cases where competitors are employing different revenue recognition approaches, over a long enough period of time (typically a year) these practices tend to "even out," so while financials for a given franchise in a given month may be skewed you should still be able to make useful comparisons across competitors when analyzing annual revenue figures.

Cash Flow is not the same thing as Profit

Cash flow reflects the total cash a business generates vs. the cash a business expends in a given period of time. Importantly, cash flow is not the same thing as profit (net income). For those not familiar with accounting rules, this disparity can seem highly counterintuitive, so it's worth exploring.

Profit is a GAAP measure of revenue minus expenses; as such, profit reflects whatever revenue and cost / expense recognition policy a franchise chooses to employ. Under GAAP accounting, revenue and costs / expenses may be recognized well before or well after the associated cash is actually obtained or expended. In addition, certain expenses may not reflect actual cash going out the door (see the discussion of non-cash expenses depreciation and amortization, below).

Cash flow, on the other hand, is a fairly cut-and-dry accounting of the movement of cash into and out of the company's bank account and therefore not subject to the timing and revenue / expense recognition considerations of a profit / net income calculation.

Costs vs. Expenses

In a profit and loss (P&L) statement, people often say that the numbers that drive the "loss" side of the analysis consist of costs and expenses. While the terms are often used interchangeably, costs and expenses are actually not exactly the same thing.

Both costs and expenses are forms of expenditures (in cash, labor, the consumption of assets, or otherwise) that a company will make in the course of its business. The distinction lies in how these expenditures are reflected in the company's financial statements. The following example should shed a bit of light:

Let's assume that you run an Express Oil Change service station. It's a sunny summer Friday and you're planning for next week's business, which you expect to be especially robust on account of people servicing their cars in advance of the July 4 holiday. You go out and purchase, from your parts supplier, $20,000 worth of air filters.

Your business, at this moment, has incurred a $20,000 cost. But should you record that cost as an expense? The answer is no. The cost is not yet reflected on your profit and loss (P&L) statement as an expense, but is instead recorded on your balance sheet as a $20,000 asset known as "inventory".

During the following week you end up using $15,000 worth of the $20,000 of air filters you had purchased to service your customers. (Note that we're talking about the amount you were charged by your supplier for the air filters, not the amount you charged your customers for the filter installations). To reflect this on your books, you record a $15,000 expense on your P&L. (Confusingly, this expense is classified as "cost of goods sold" or "cost of sales" on the profit and loss statement). Meanwhile, the unused $5,000 worth of air filters remain on your company's balance sheet as inventory.

The following week, you use up the remaining $5,000 of air filters, so the inventory on your balance sheet is reduced by $5,000 and you record a $5,000 expense on your P&L. In this manner, then, your $20,000 air filter cost was eventually expensed on your profit and loss statement.

How do you decide when to record a cost as an inventory item on the balance sheet as opposed to an expense on the P&L? Generally speaking, revenues and expenses are matched. Until you actually use up the inventory, its cost remains an inventory asset on your balance sheet. When you later recognize the revenue that was generated by using up your inventory, you reduce your inventory by its cost and reflect that cost as an expense (cost of goods sold / cost of sales) on your P&L.

Note that there are some costs that get immediately expensed on the P&L (i.e., they are never recorded on the balance sheet). For example, in most businesses, costs not directly associated with acquiring, producing, or delivering the product will be immediately expensed (typically, in the period in which they occur). For example, "overhead" costs such as rent, the software you use to do your accounting, your monthly phone and internet bills, your costs of the marketing, etc. are generally recorded immediately as expenses.

Non-Cash Expenses

A discussion of profit and loss calculations must mention non-cash expenses such as depreciation and amortization.

Depreciation and amortization are sister concepts, with the distinction that depreciation deals with tangible assets and amortization with intangible assets:

- The concept of allocating the cost of a tangible asset over its useful life is called depreciation. For example, if a company buys a machine for $1 million and the machinery has an estimated useful life of five years (the IRS provides guidelines for useful life of various assets), the machinery would likely be "depreciated" (its consumption expensed on the P&L) over a period of five years at a rate of $200,000 per year.

- Amortization refers to the allocation of the cost of an intangible asset over its useful life. For example, if an individual buys a 5-year franchise license that with a franchise fee of $25,000, the franchise fee would probably be amortized (expensed on the P&L) over five years at a rate of $5,000 per year.

Why are depreciation and amortization referred to as "non-cash" expenses? The reason is that there are no cash expenditures going out the door as a company expenses the consumption of a tangible asset (depreciates it) or intangible asset (amortizes it) over time. The cash paid for the asset, if any, was expended back when the asset was first acquired (e.g., when the machine was purchased or the franchise license was obtained). Since the asset is being used up over some period of time, the company will expense the cost of the asset over time on its P&L in the form of depreciation or amortization.

Closing Thoughts on Advanced Franchise Accounting

A discussion of accounting can go much, much deeper, to be sure, with all kinds of complexity, exceptions, and special rules. However, once you grasp the concepts described above, you will have an extremely solid base from which to work with your accountant to analyze nearly any franchise opportunity in great detail.

Ultimate franchising guide

All you need to know as a first time franchisee: Step by step guidance from experienced franchise professionals.